Wakemed (NC)

WakeMed is demanding price hikes of nearly 40%

We are working to keep costs affordable for families and employers in North Carolina

We are attempting to negotiate with WakeMed to renew our network relationship. Our goal is to reach an agreement that is affordable for North Carolinians and local employers while maintaining continued, uninterrupted network access to WakeMed.

Unfortunately, despite our repeated efforts to engage in good-faith discussions, WakeMed has continued to stall and delay our negotiation, just as they have done in negotiations with multiple health plans over the past few years.

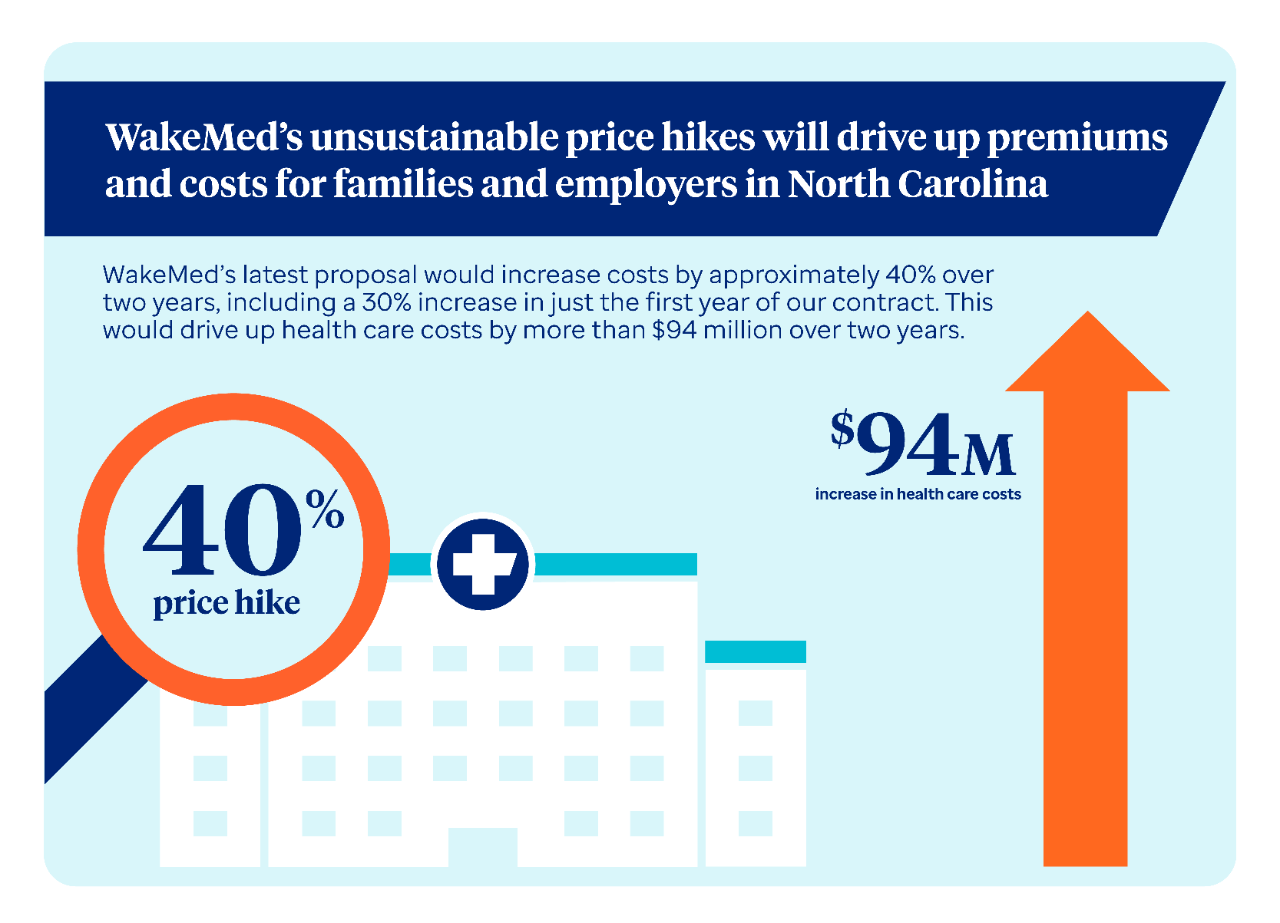

With only two weeks before our contract is set to expire on Nov. 15, WakeMed delivered its first comprehensive proposal in the entirety of our negotiation. Instead of working toward a compromise North Carolina families can afford, WakeMed is demanding unsustainable price hikes of nearly 40%, including a 30% increase in just the first year of our contract. WakeMed’s proposal would increase health care costs for consumers and employers by more than $94 million over two years.

In the event we are unable to reach an agreement, WakeMed’s facilities and specialty providers in the Raleigh region will be out of network for people enrolled in the following plans, effective Nov. 15, 2025:

- Employer-sponsored and individual commercial plans

- Medicare Advantage plans, including Group Retiree, and Dual Special Needs Plan (DSNP)

Primary care physicians employed by WakeMed are not impacted by this negotiation and will remain in-network, regardless of the outcome of our negotiation.

People enrolled in our Medicaid plans are not impacted. They will continue to have network access to WakeMed on and after Nov. 15. This does not impact Medicare Supplement plans. People enrolled in a Medicare Supplement plan can continue accessing care with WakeMed on and after Nov. 15, 2025.

WakeMed is demanding unsustainable price hikes of nearly 40%, including a 30% increase in just the first year of our contract

WakeMed’s proposal would increase health care costs for consumers and employers in North Carolina by more than $94 million over two years.

Excessive rate increases drive up overall health care costs, directly resulting in a financial strain for the people we serve.

Agreeing to WakeMed’s proposal would also significantly drive-up premiums and out-of-pocket costs for consumers, as well as the cost of doing business for employers, impacting their ability to offer affordable health care coverage for their employees.

We are proposing market-competitive rates that will continue to reimburse WakeMed consistent with its peers in the market while slowing the unsustainable rise in health care costs.

We are asking WakeMed to join us at the negotiating table and work toward an agreement.

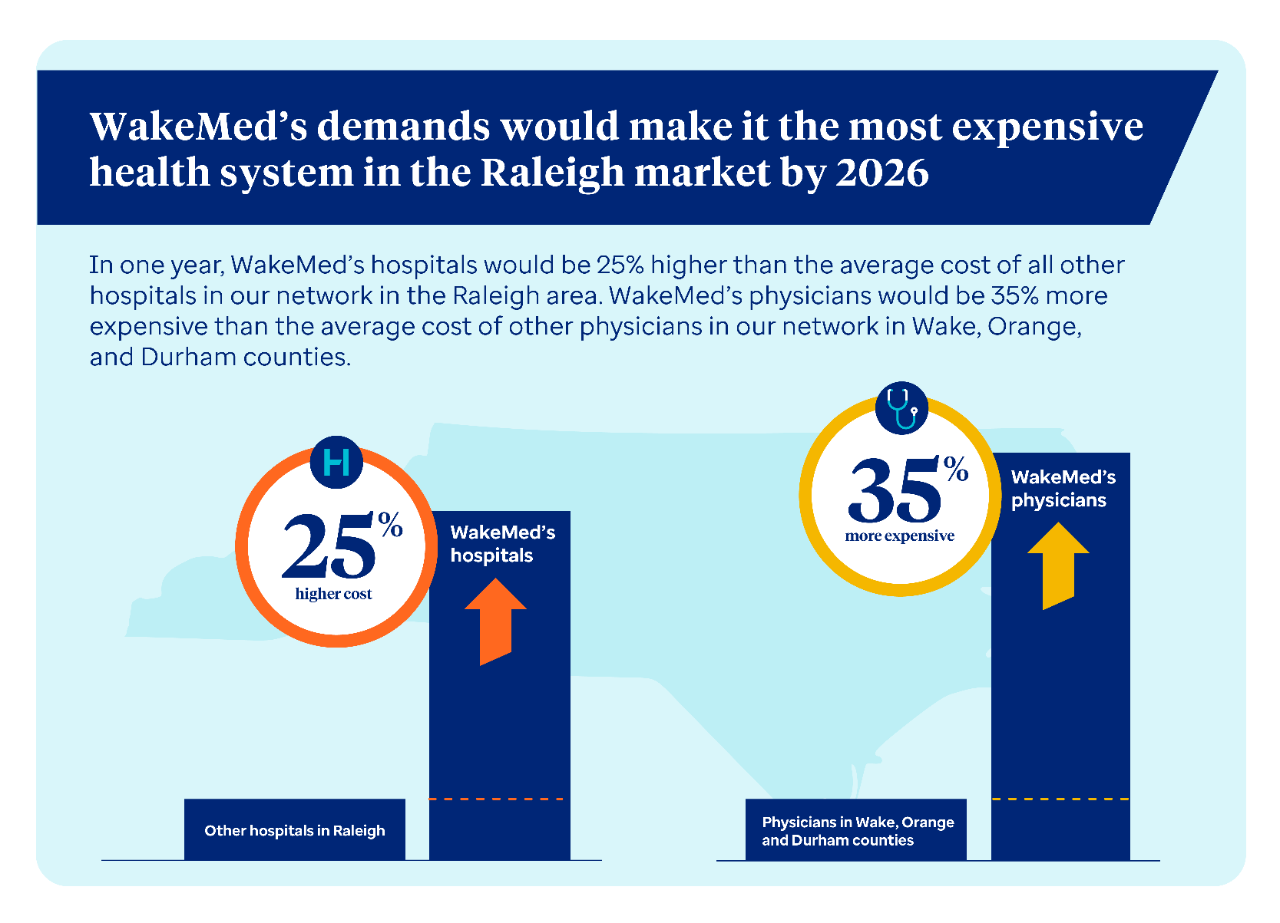

WakeMed’s demands for a 30% price hike in just the first year of our contract would make it the most expensive health system in the Raleigh market by 2026

WakeMed’s proposal would make its hospitals 25% higher than the average cost of all other hospitals in the Raleigh area, which includes academic health systems such as Duke Health and UNC Health.

WakeMed’s physicians would be nearly 35% more expensive than the average cost of other physicians in our network in Wake, Orange, and Durham counties.

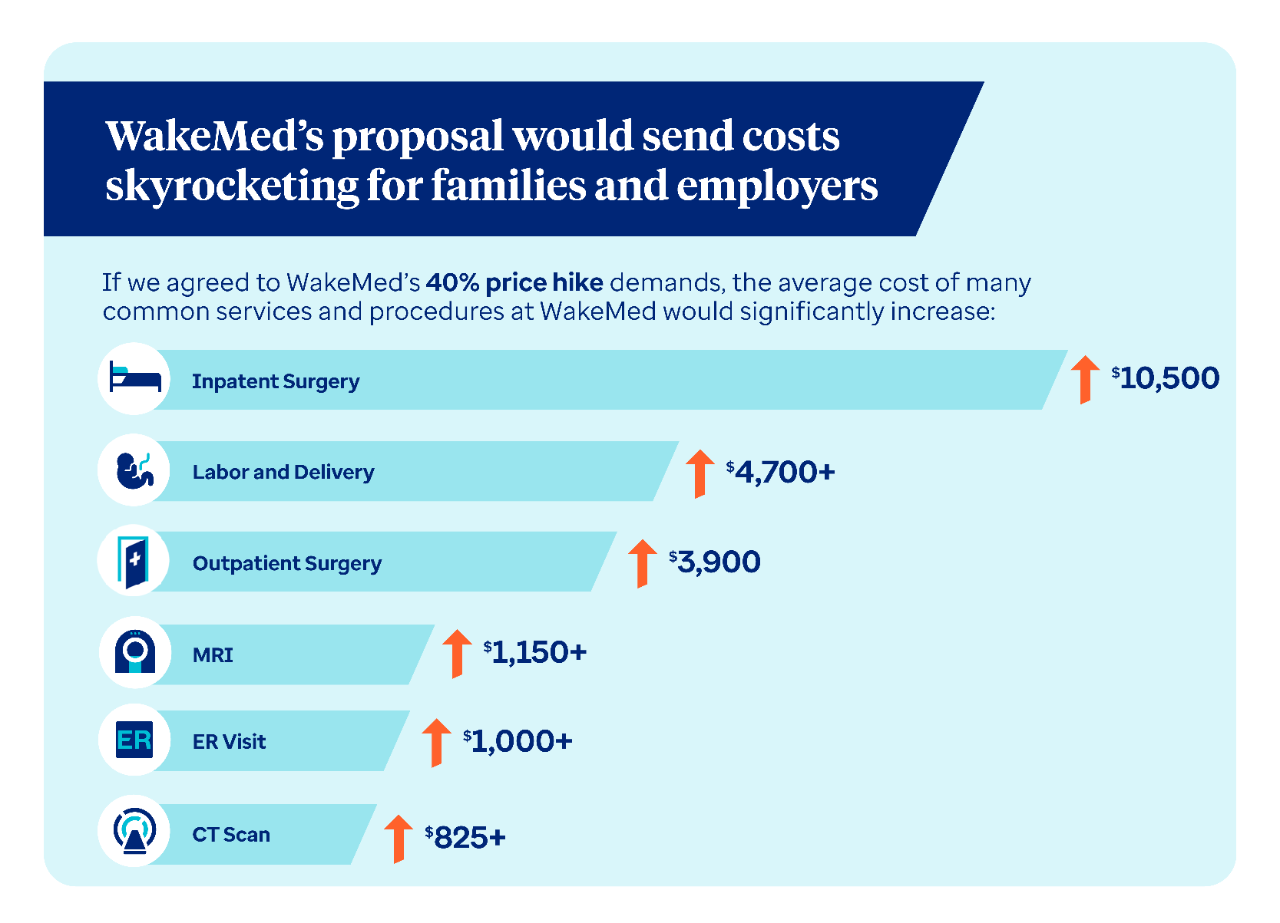

WakeMed’s proposed price hikes would significantly drive up the cost of many common services and procedures at WakeMed

To help illustrate the impact of WakeMed’s proposal, consider the following examples:

- A typical inpatient surgery would cost nearly $10,500 more than that same surgery costs today

- The average cost of an ER visit would increase by more than $1,000

- An obstetrics/labor & delivery admission would cost over $4,700 more than it does today

- WakeMed would charge an additional $1,150 for a typical MRI and $825 more for a CT scan

- A common outpatient surgery would cost nearly $3,900 more

Employers in North Carolina would bear the brunt of WakeMed’s price hike demands

Our self-funded employer group customers have charged us with the responsibility of providing their employees access to quality, affordable health care.

We pass any savings from negotiating more competitive rates directly to our self-funded customers, which they could in turn use to hold premiums steady for employees or to lower them in some cases.

More than 70% of our employer-sponsored members in North Carolina are enrolled in self-funded plans, which means that these employers pay the cost of their employees’ medical bills themselves rather than relying on UnitedHealthcare to pay those claims.

As the prices for health care continue to rise, employers have less money available to help grow the business through things like investments in new technologies or salary increases for hard-working employees.