NewYork-Presbyterian

NewYork-Presbyterian (NYP) is one of the most expensive health systems in the country and is demanding a 12% price hike in one year

We are actively negotiating with NYP to renew our network relationship. Our goal is to reach an agreement that is affordable for New Yorkers and employers and to slow the unsustainable rise in skyrocketing health care costs at NYP.

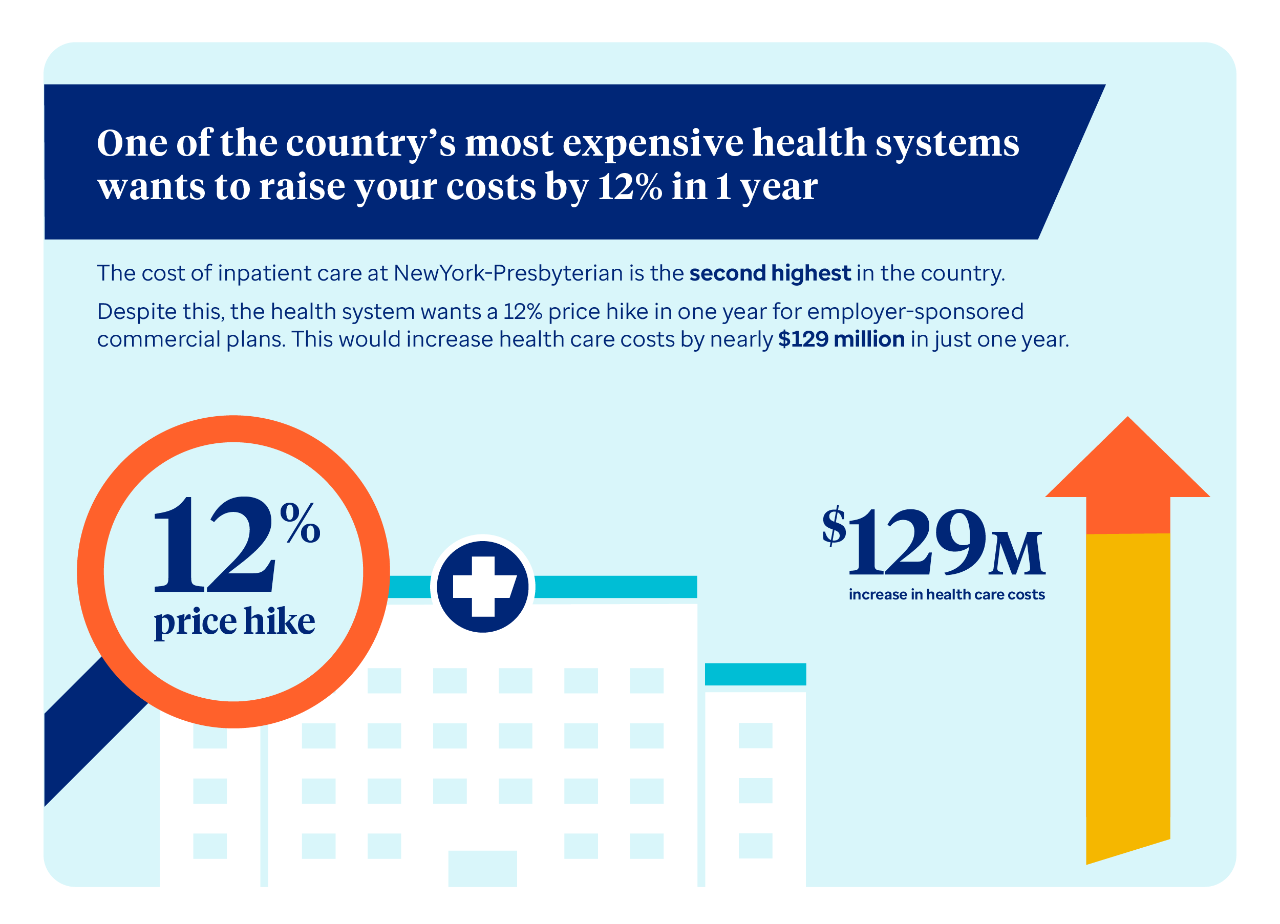

NYP's proposal would increase health care costs for consumers and employers by $129 million

NYP costs significantly more than peer health systems throughout New York City, yet it is seeking to increase its costs by 12% in just the first year of our contract for our employer-sponsored commercial plans. NYP’s proposal would increase health care costs for consumers and employers by $129 million in just one year, driving up premiums, out-of-pocket costs and the cost of doing business for New York companies.

In the event we are unable to reach an agreement, NYP’s hospitals, facilities and its physicians will be out of network for the following plans, effective Jan. 1, 2026:

- UnitedHealthcare employer-sponsored commercial plans

- Oxford commercial plans

- Dual Special Needs Plan (DSNP)

- Medicaid

- Essential Plan

- Individual Family Plan (IFP)

- United Transplant Network

- United Behavioral Health

- Cancer Resource Network

NYP will definitively be out of network for UnitedHealthcare Medicare Advantage individual plans as well as Medicare Advantage Group Retiree plans, effective Jan. 1, 2026. We are not renewing our relationship with NYP for these plans.

People enrolled in a Medicare Supplement plan are not impacted by this change. They can continue to receive care at NYP’s hospitals, facilities and its physicians on and after Jan. 1, 2026.

NYP’s employed physicians, ancillary locations and certain outpatient hospital services, such as speech therapy and cardiac rehab, would be out of network for people enrolled in the United Empire Plan (NYSHIP), effective Jan. 1, 2026.

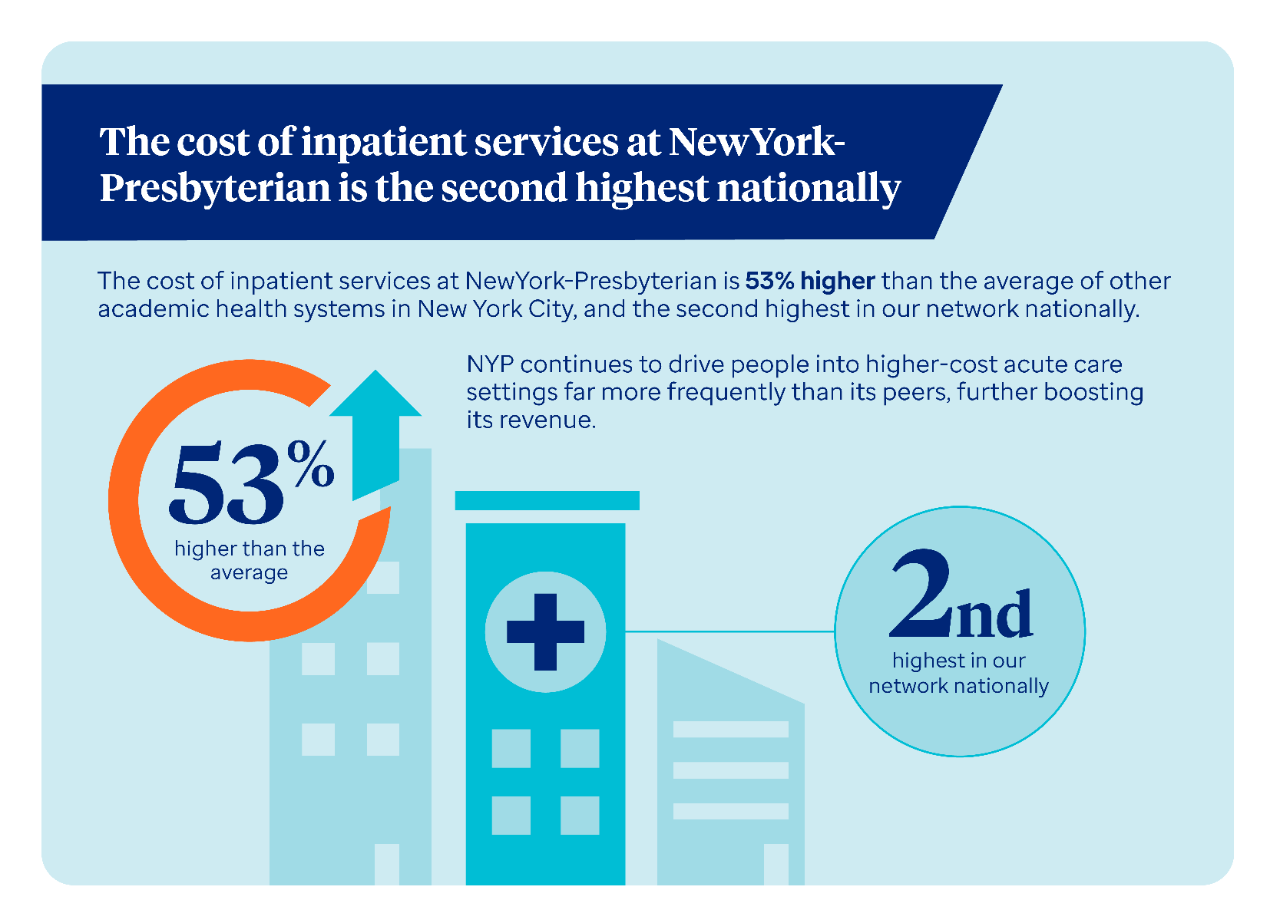

The cost of inpatient services at NYP’s hospitals is the second-highest in our network nationally

The cost of inpatient services at NYP is 53% higher than the average of other academic health systems in New York City.

Many health systems across the country are shifting more care to lower cost, high-quality care settings. However, NYP continues to drive people into higher cost acute-care facilities far more frequently than its peers, further driving up costs for consumers and employers.

NYP’s exorbitant rates are particularly impactful given that inpatient care makes up more than 70% of the revenue at its hospitals, compared to just over 40% at other academic hospitals throughout New York City.

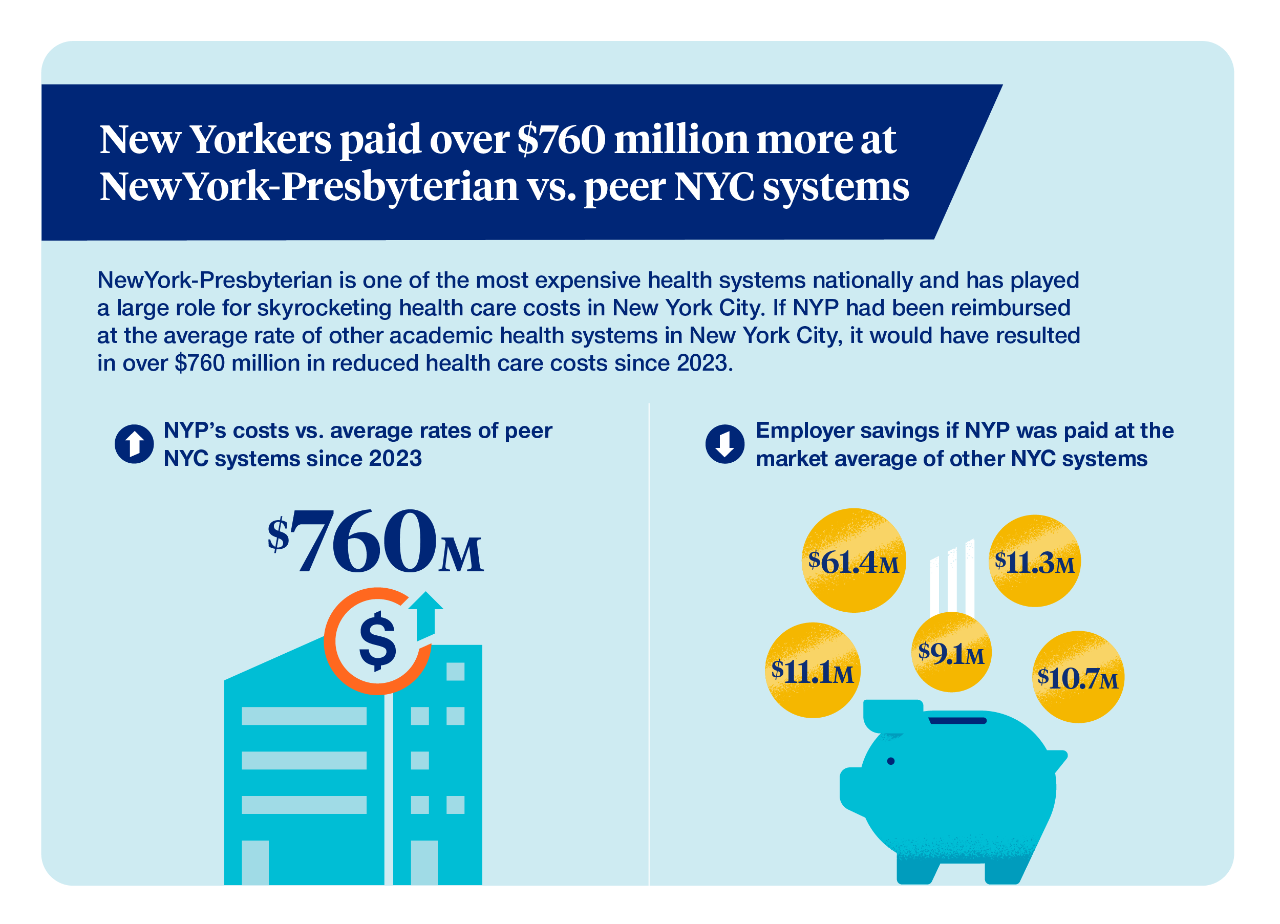

NYP is one of the leading drivers of skyrocketing health care costs for New Yorkers and employers

If NYP had been reimbursed at the average rate of other academic health systems in our commercial network in New York City, it would have resulted in over $760 million in reduced health care costs since 2023 to date.

One self-funded employer would have saved over $61 million in health care costs during that time, while four others would have recorded cost-savings between $9 million to more than $11 million each.

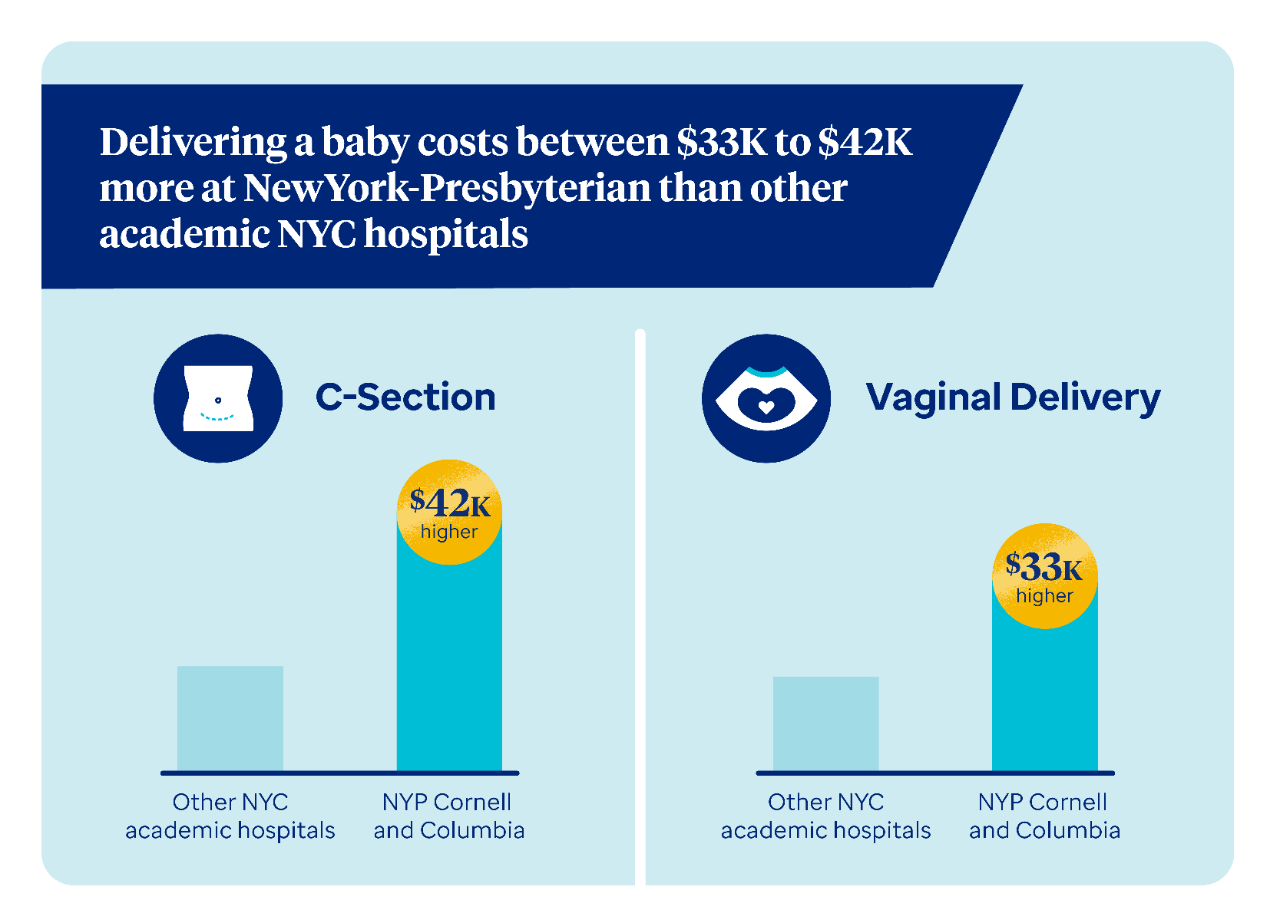

NYP’s high costs place a large financial burden on families, turning childbirth into a luxury service rather than a community benefit

Delivering a baby via a C-section costs approximately $42,000 more at NYP’s Cornell and Columbia hospitals compared to the average cost at other New York City academic hospitals in our network.

The cost of a vaginal delivery is approximately $33,000 more at NYP’s Cornell and Columbia hospitals compared to the average cost at peer academic systems in New York City.

NYP’s demands for a 12% price hike in one year for our commercial plans would only further the financial gap between NYP and its peers. The cost of a C-section would be $50,000 more than the average cost at other academic hospitals in New York City, while a vaginal delivery would be $39,000 more on average.

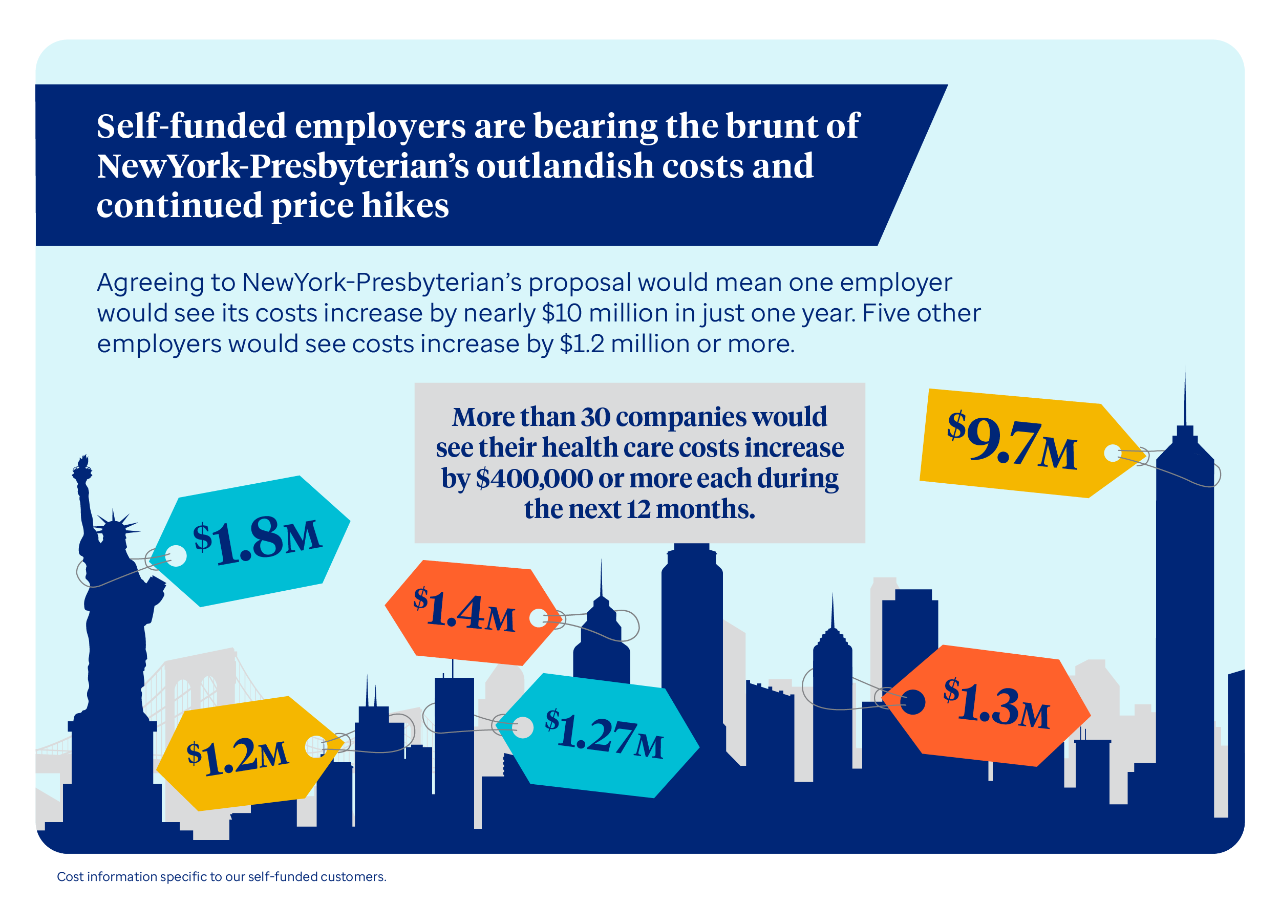

More than 50% of NYP’s price hike demands for our commercial plans would come out of the operating budgets of self-funded employers

Approximately 50% of UnitedHealthcare members in New York City are enrolled in self-funded plans – meaning their employers pay the cost of their employees’ medical bills themselves.

Agreeing to NYP’s proposal would mean one employer would see its costs increase by nearly $10 million in just one year. Five other employers would see costs increase by $1.2 million or more each. More than 20 companies would see at least a $500,000 increase or more each, while over 30 would experience a $400,000 increase or more in health care costs each during the next 12 months.

These employers have charged us with the responsibility of providing their employees access to quality, affordable health care. NYP’s exorbitant costs and continued double-digit price hike demands come straight out of these employers’ bottom lines. As the prices for health care continue to rise, less money is available to pay salaries, invest in new technologies or help grow the business.