Paying for health care made simpler

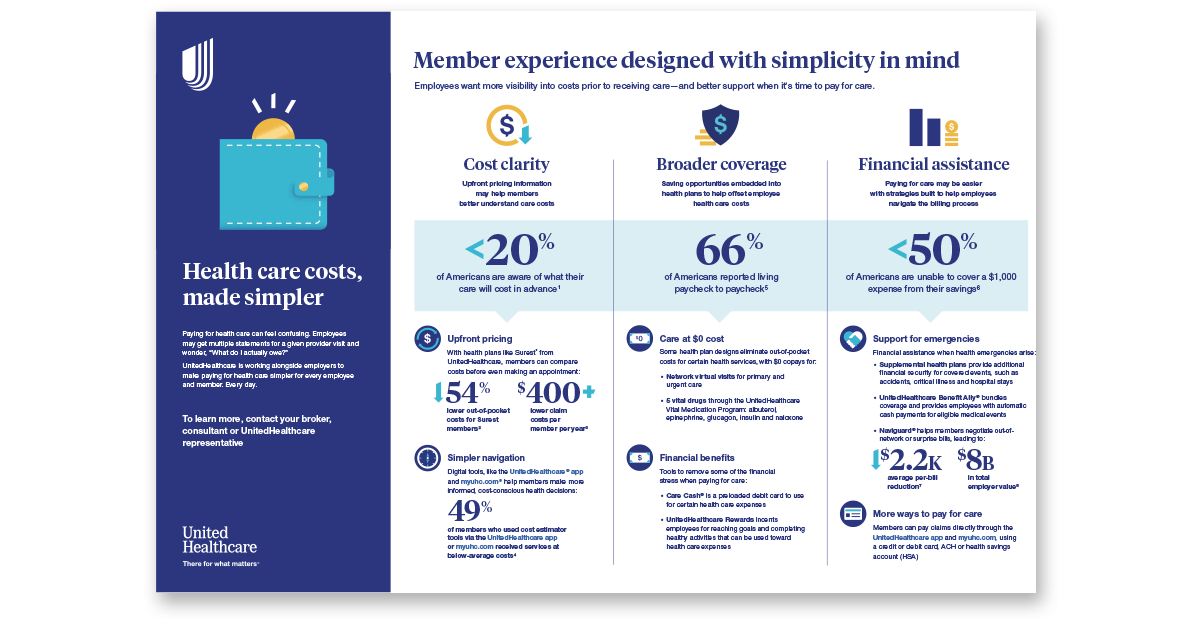

Employees want more visibility into costs prior to receiving care, but they’re also looking for support when it comes time to pay for that care.

In today's complex and often overwhelming health care landscape, the cost of medical services remains a top concern for employees. Many find themselves struggling to understand and manage the financial aspects of their health care, from deciphering insurance jargon to navigating the maze of bills and payments.

This is where UnitedHealthcare steps in, aiming to simplify and demystify the process for its members both before care is rendered and after. By streamlining billing processes, offering tools to help employees budget and pay for expenses and providing robust support when unexpected bills arise, UnitedHealthcare is committed to making the experience of paying for health care a little less daunting.

For employers, this may lead to a decrease in noise and complaints from members and higher employee satisfaction with their plan. Plus, when employees don’t have to worry as much about the act of paying for and affording care, their financial stress may lessen, which is linked with higher productivity levels,1 creating a win-win situation for both the employee and the organization.

Streamlined billing and payment processes

About 40% of Americans find medical bills confusing,2 which underscores the need for carriers to streamline and simplify billing and payment processes.

UnitedHealthcare, for instance, has introduced more thorough claims processing, quicker claims payouts and simpler Explanations of Benefits (EOBs). These enhancements provide members with a clearer understanding of their financial obligations, reducing the likelihood of errors and confusion. Members can track their claims and make payments directly through the UnitedHealthcare® app or myuhc.com® using a variety of payment methods, including credit or debit cards, ACH and health savings accounts (HSAs). This digital transformation not only helps simplify the payment process but also empowers members to take control of their health care finances.

Help with budgeting for health care expenses

With around 3 in 4 U.S. adults indicating worry over being able to afford health care services,3 it’s critical that carriers provide the ability for employees to set aside money for health care bills.

That can look like health savings accounts (HSAs), health reimbursement accounts (HRAs) and flexible spending accounts (FSAs), which allow employees to set aside pretax dollars for qualifying health care expenses. These accounts can provide a financial buffer, making it easier for employees to manage both planned and unplanned health care costs. UnitedHealthcare also offers Care Cash®, a debit card that is preloaded with a set amount of money that can be used toward certain network health care expenses, helping to ensure that members can pay for necessary services without additional financial strain.

Financial support for unplanned health care costs

Half of U.S. adults can’t cover an unexpected expense of $1,000,4 which highlights the importance of offering financial support during unexpected health events.

Supplemental health plans, for instance, provide a lump-sum benefit to help cover out-of-pocket costs and lost wages related to accidents, critical illnesses, hospital stays and qualifying short-term disability claims. This financial assistance can be a crucial lifeline for employees who may struggle to cover unexpected expenses. Benefit Assist® works to take this a step further by enabling more proactive benefit payouts for qualifying claims — oftentimes without any action needed by the member to initiate those payouts.

Bill management programs, such as Naviguard® from UnitedHealthcare, can also help, offering members assistance in navigating and resolving out-of-network or surprise bills. This support ensures that members are not left to fend for themselves in the face of complex and often overwhelming medical bills, making the process of managing health care expenses more straightforward and less stressful.